Alignment from the get-go.

Our approach

Before any investment, we take the time to understand what matters most to you — where you are, where you’re heading, and what success looks like over the short, medium, and long term.

That means honest conversations, clear expectations, and a shared understanding of risk, return, and responsibility.

It’s a principled approach — and one that sets the tone for the partnership ahead.

Uniquely Bespoke

Your Portfolio

Once we’re aligned, we design a portfolio to suit your specific profile — from asset allocation and sector exposure to income, growth, and liquidity preferences.

Every decision — every asset, every weighting — is clearly documented and communicated. You'll understand not only what you own, but why you own it.

We provide full transparency on pricing, performance, fees, and our investment rationale, always ensuring you’re informed.

Markets Evolve. Trust Endures.

Active management for a changing world.

Markets shift, cycles turn, and conditions evolve — but our process stays anchored in discipline and conviction.

We actively manage your portfolio, rebalancing as required and making timely, evidence-based decisions to keep your portfolio aligned with both your objectives and the realities of the market.

It’s this constant oversight — paired with ongoing conversations and consistent reporting — that ensures we remain accountable, agile, and truly client-centred.

Our process

Great outcomes are never accidental. They are the product of strong governance, smart systems, and disciplined execution:

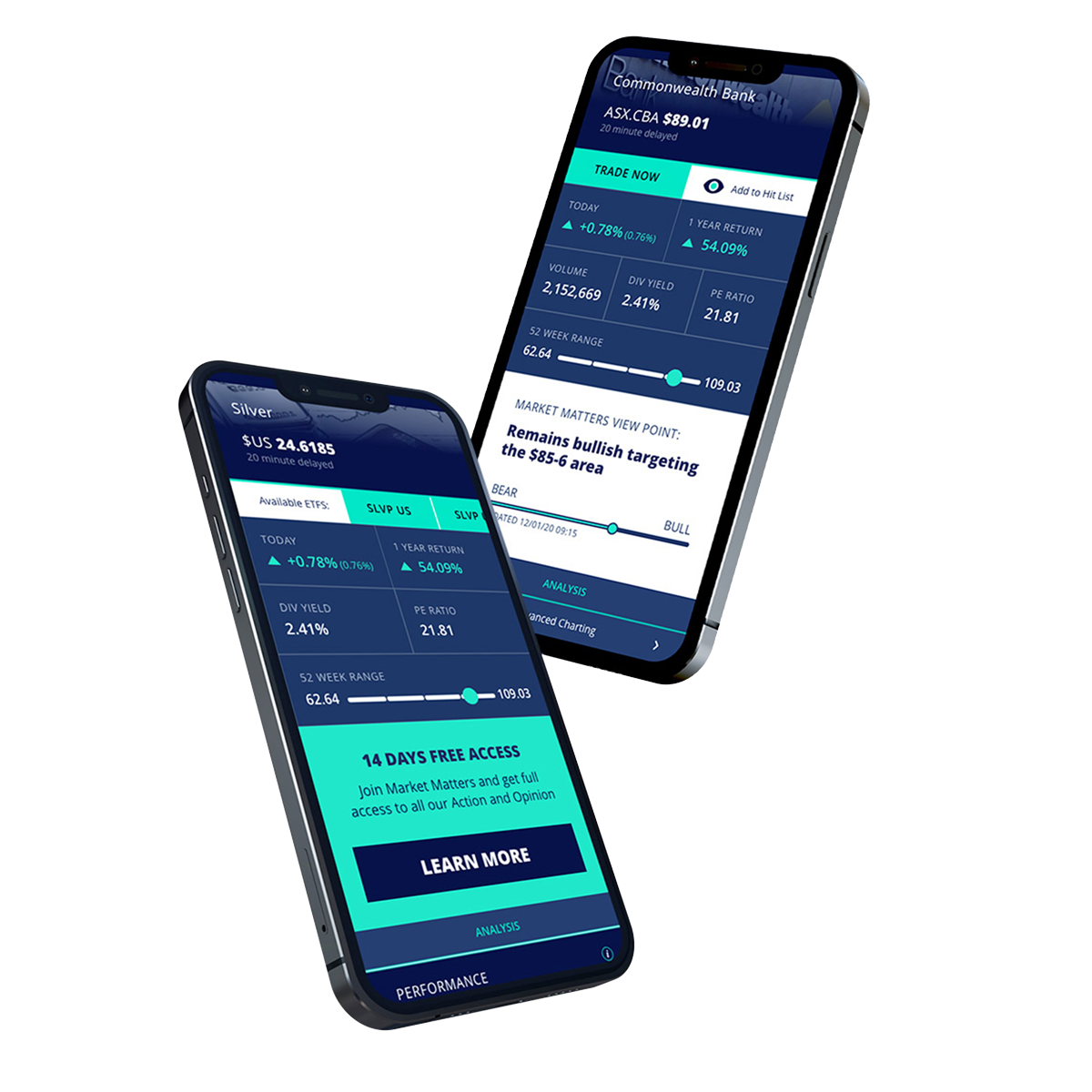

Technology that delivers clarity

We utilise best-in-class platforms to bring total transparency to your portfolio — in real time. From dynamic asset pricing to performance reporting, our technology ensures you see exactly what we see, when we see it.

Rigorous governance

Every portfolio decision is made within a clear, documented framework. We operate with policies and procedures that ensure compliance, consistency, and accountability — from asset selection to risk allocation.

Risk management that’s always aligned

From the outset, we take the time to understand what matters most to you — your goals, your risk tolerance, and your expectations. This allows us to protect capital with the same discipline we use to grow it — ensuring your strategy stays aligned with your goals, even when the market shifts.

Partnerships

Market Matters

Every Market Partners client also receives a complimentary membership of Market Matters; one of Australia's most respected sources of independent digital investment advice.

Built by Market Partners own James Gerrish, clients will receive comprehensive daily analysis, reports, charts, and data.

At Market Partners, our clients also gain access to select private market opportunities — investments typically out of reach for most individuals.

Leveraging our extensive network and institutional experience, we identify and secure opportunities that align with our clients’ objectives and our own high standards.

- Private equity and co-investments

- Targeted real estate development projects

- Venture capital and early-stage growth

- Select alternative strategies

Each opportunity is thoroughly assessed by our investment committee — evaluated not just for return potential, but for its role within your broader portfolio, its alignment with your risk profile, and its long-term strategic value.

Expressions of Interest

Every great partnership begins with a conversation.

Stay in touch

Our latest insights

FY25 Reporting Calendar

Australian reporting season officially commences on the 1st August, concluding Friday 29th August, though some companies will report outside of that window.

READ

FY26 Market Outlook

Markets enter FY26 near record highs, but elevated tariffs, geopolitical tensions, and uncertainty around interest rates mean investors shouldn’t get complacent.

READ

FY25 Review: Markets Close FY25 with Strength Despite Policy and Geopolitical Headwind

Markets closed FY25 near record highs after rebounding from an April correction. Tariff relief, resilient earnings, and easing inflation drove the recovery — but risks remain.

READ

What might the proposed changes to Superannuation actually mean?

The new Division 296 tax targets super balances over $3 million, applying an extra 15% tax on earnings — including unrealised gains. We break down how it works, who it affects, and the strategic decisions investors may need to consider.

READ